Пост капитализам

Capitalism as we know it is over. So suggests a new report commissioned by a group of scientists appointed by the UN secretary general. The main reason? We’re transitioning rapidly to a radically different global economy, due to our increasingly unsustainable exploitation of the planet’s environmental resources and the shift to less efficient energy sources.

Climate change and species extinctions are accelerating even as societies are experiencing rising inequality, unemployment, slow economic growth, rising debt levels, and impotent governments. Contrary to the way policymakers usually think about these problems these are not really separate crises at all.

These crises are part of the same fundamental transition. The new era is characterised by inefficient fossil fuel production and escalating costs of climate change. Conventional capitalist economic thinking can no longer explain, predict or solve the workings of the global economy in this new age.

Energy shift

Those are the implications of a new background paper prepared by a team of Finnish biophysicists who were asked to provide research that would feed into the drafting of the UN Global Sustainable Development Report (GSDR), which will be released in 2019.

For the “first time in human history”, the paper says, capitalist economies are “shifting to energy sources that are less energy efficient.” Producing usable energy (“exergy”) to keep powering “both basic and non-basic human activities” in industrial civilisation “will require more, not less, effort”.

At the same time, our hunger for energy is driving what the paper refers to as “sink costs.” The greater our energy and material use, the more waste we generate, and so the greater the environmental costs. Though they can be ignored for a while, eventually those environmental costs translate directly into economic costs as it becomes more and more difficult to ignore their impacts on our societies.

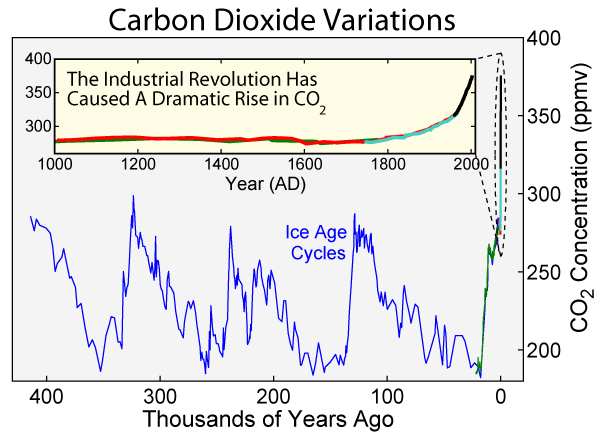

And the biggest “sink cost”, of course, is climate change: “Sink costs are also rising; economies have used up the capacity of planetary ecosystems to handle the waste generated by energy and material use. Climate change is the most pronounced sink cost.”

Overall, the amount of energy we can extract, compared to the energy we are using to extract it, is decreasing “across the spectrum – unconventional oils, nuclear and renewables return less energy in generation than conventional oils, whose production has peaked – and societies need to abandon fossil fuels because of their impact on the climate.”

The UN

A copy of the paper, available on the website of the BIOS Research Unit in Finland, was sent to me by lead author Dr Paavo Järvensivu, a ‘biophysical economist’ – a rare, but emerging breed of economist exploring the role of energy and materials in fuelling economic activity.

More for less: We’re using more and more energy to extract smaller quantities of fossil fuels (Getty)

I met Dr Järvensivu last year when I spoke at the BIOS Research Unit about the findings of my own book,

Failing States, Collapsing Systems: BioPhysical Triggers of Political Violence.

The UN’s GSDR is being drafted by an independent group of scientists (IGS) appointed by the UN Secretary general. The IGS is supported by a range of UN agencies including the UN Secretariat, the UN Educational, Scientific and Cultural Organization, the UN Environment Programme, the UN Development Programme, the UN Conference on Trade and Development and the World Bank.

The paper, co-authored by Dr Järvensivu with the rest of the BIOS team, was commissioned by the UN’s IGS specifically to feed into the chapter on ‘Transformation: the Economy’. Invited background documents are used as the basis of the GSDR, but what ends up in the final report will not be known until it is released next year.

The BIOS paper suggests that much of the political and economic volatility we have seen in recent years has a root cause in this creeping ecological crisis. As the ecological and economic costs of industrial overconsumption continue to rise, the constant economic growth we have become accustomed to is now in jeopardy. That, in turn, has exerted massive strain on our politics.

But the underlying issues are still unacknowledged and unrecognised by policymakers.

More in, less out

“We live in an era of turmoil and profound change in the energetic and material underpinnings of economies. The era of cheap energy is coming to an end,” says the paper.

Conventional economic models, the Finnish scientists note, “almost completely disregard the energetic and material dimensions of the economy.”

The scientists refer to the pioneering work of systems ecologist Professor Charles Hall of the State University of New York with economist Professor Kent Klitgaard from Wells College. This year, Hall and Klitgaard released an updated edition of their seminal book,

Energy and the Wealth of Nations: An Introduction to BioPhysical Economics.

Hall and Klitgaard are highly critical of mainstream capitalist economic theory, which they say has become divorced from some of the most fundamental principles of science. They refer to the concept of “energy return on investment” (EROI) as a key indicator of the shift into a new age of difficult energy. EROI is a simple ratio that measures how much energy we use to extract more energy.

“For the last century, all we had to do was to pump more and more oil out of the ground,” say Hall and Klitgaard. Decades ago, fossil fuels had very high EROI values – a little bit of energy allowed us to extract large amounts of oil, gas and coal.

But as I’ve previously reported, this is no longer the case. Now we’re using more and more energy to extract smaller quantities of fossil fuels. Which means higher production costs to produce what we need to keep the economy rolling. The stuff is still there in the ground – billions of barrels worth to be sure, easily enough to fry the climate several times over.

But it’s harder and more expensive to get out. And the environmental costs of doing so are rising dramatically, as we’ve caught a glimpse of with this summer’s global heatwave.

Riding blind

These costs are not recognised by capitalist markets. They literally cannot be seen. Earlier in August, billionaire investor Jeremy Grantham – who has a track record of consistently calling financial bubbles – released an update to his April 2013 analysis, The Race of Our Lives.

The new paper provides a bruising indictment of contemporary capitalism’s complicity in the ecological crisis. Grantham’s verdict is that “capitalism and mainstream economics simply cannot deal with these problems” – namely, the systematic depletion of planetary ecosystems and environmental resources:

“The replacement cost of the copper, phosphate, oil, and soil – and so on – that we use is not even considered. If it were, it’s likely that the last 10 or 20 years (for the developed world, anyway) has seen no true profit at all, no increase in income, but the reverse.”

Efforts to account for these so-called ‘externalities’ by calculating their actual costs have been well-meaning, but have had negligible impact on the actual operation of capitalist markets.

Sink costs: the greater our energy and material use, the more waste we generate, and so the greater the environmental costs (Getty)

In short, according to Grantham, “we face a form of capitalism that has hardened its focus to short-term profit maximisation with little or no apparent interest in social good.”

Yet for all his prescience and critical insights, Grantham misses the most fundamental factor in the great unravelling in which we now find ourselves: the transition to a low EROI future in which we simply cannot extract the same levels of energy and material surplus that we did decades ago.

Grantham’s blind eye is mirrored by the British economics journalist Paul Mason in his book

Postcapitalism: A Guide to Our Future, who theorises that information technology is paving the way for the emancipation of labour by reducing the costs of knowledge production – and potentially other kinds of production that will be transformed by AI, blockchain, and so on – to zero. Thus, he says, will emerge a utopian ‘postcapitalist’ age of mass abundance, beyond the price system and rules of capitalism.

It sounds peachy, but Mason completely ignores the colossal, exponentially increasing physical infrastructure for the ‘internet-of-things’. His digital uprising is projected to consume evermore vast quantities of energy (as much as one-fifth of global electricity by 2025), producing 14 per cent of global carbon emissions by 2040.

Toward a new economic operating system

Most observers, then, have no idea of the current biophysical realities – that the driving force of the transition to postcapitalism is the end of the age that made endless growth capitalism possible in the first place: the age of abundant, cheap energy.

And so we have moved into a new, unpredictable and unprecedented space in which the conventional economic toolbox has no answers. As slow economic growth simmers along, central banks have resorted to negative interest rates and buying up huge quantities of public debt to keep our economies rolling. But what happens after these measures are exhausted? Governments and bankers are running out of options.

“It can be safely said that no widely applicable economic models have been developed specifically for the upcoming era,” write the Finnish scientists for the UN drafting process.

Having identified the gap, they lay out the opportunities for transition. But capitalist markets will not be capable of facilitating the required changes – governments will need to step up, and institutions will need to actively shape markets to fit the goals of human survival.

“More expensive energy doesn’t necessarily lead to economic collapse,” lead author Paavo Järvensivu says. “Of course, people won’t have the same consumption opportunities, there’s not enough cheap energy available for that, but they are not automatically led to unemployment and misery either.”

In this low EROI future, we simply have to accept the hard fact that we will not be able to sustain current levels of economic growth. “Meeting current or growing levels of energy need in the next few decades with low-carbon solutions will be extremely difficult, if not impossible,” the paper finds. The economic transition must involve efforts “to lower total energy use.”

Promoting biking and walking is one way to lower energy use (Getty)

Key areas to achieve this include transport, food and construction. City planning needs to adapt to the promotion of walking and biking, a shift toward public transport, as well as the electrification of transport. Homes and workplaces will become more connected and localised. Meanwhile, international freight transport and aviation cannot continue to grow at current rates.

As with transport, the global food system will need to be overhauled. Climate change and oil-intensive agriculture have unearthed the dangers of countries becoming dependent on food imports from a few main production areas. A shift towards food self-sufficiency across both poorer and richer countries will be essential. And ultimately, dairy and meat should make way for largely plant-based diets.

The construction industry’s focus on energy-intensive manufacturing, dominated by concrete and steel, should be replaced by alternative materials. The BIOS paper recommends a return to the use of long-lasting wood buildings, which can help to store carbon, but other options such as biochar might be effective too.

But capitalist markets will not be capable of facilitating the required changes – governments will need to step up, and institutions will need to actively shape markets to fit the goals of human survival. Right now, the prospects for this look slim. But the new paper argues that either way, change is coming.

Whether or not this system still comprises a form of capitalism is ultimately a semantic question. It depends on how you define capitalism.

“Capitalism, in that situation, is not like ours now,” said Järvensivu. “Economic activity is driven by meaning – maintaining equal possibilities for the good life while lowering emissions dramatically – rather than profit, and the meaning is politically, collectively constructed. Well, I think this is the best conceivable case in terms of modern state and market institutions. It can’t happen without considerable reframing of economic-political thinking, however.”

. Ќе ти верувам дека СО2 се намалува, а ова научнициве што трескаат дека маф ни е работата, немаат најнови податоци како тебе.

. Ќе ти верувам дека СО2 се намалува, а ова научнициве што трескаат дека маф ни е работата, немаат најнови податоци како тебе. , па уште и проста физика

, па уште и проста физика

. Толкав пост напишан само за мене и мојата психолошка состојба, а ниту еден збор за тоа што заклучив во претходниот пост.

. Толкав пост напишан само за мене и мојата психолошка состојба, а ниту еден збор за тоа што заклучив во претходниот пост. (уште една потврда од претходниот заклучок, дека си спинерче) .

(уште една потврда од претходниот заклучок, дека си спинерче) .

) ќе си ги лапнат разни нгоа, експерти, компании па и владини лица на сите нивоа.

) ќе си ги лапнат разни нгоа, експерти, компании па и владини лица на сите нивоа.