Интересен аналитички текст кој во читлива форма објаснува исклучително важни геополитички случувања во последнава деценија. Обврзително четиво за сите што претполагаат на основни познавања во геополитиката и светските настани.

What Are the Saudis Really Preparing for?

It was announced the other day that Saudi Arabia and China are opening a $7 billion local currency swap line.

It prompted the highest-trafficked

tweet of mine ever.

Mark Wauck over at Meaning in History linked to it. Mark didn’t really elaborate my point so I posted a reply in his comment section.

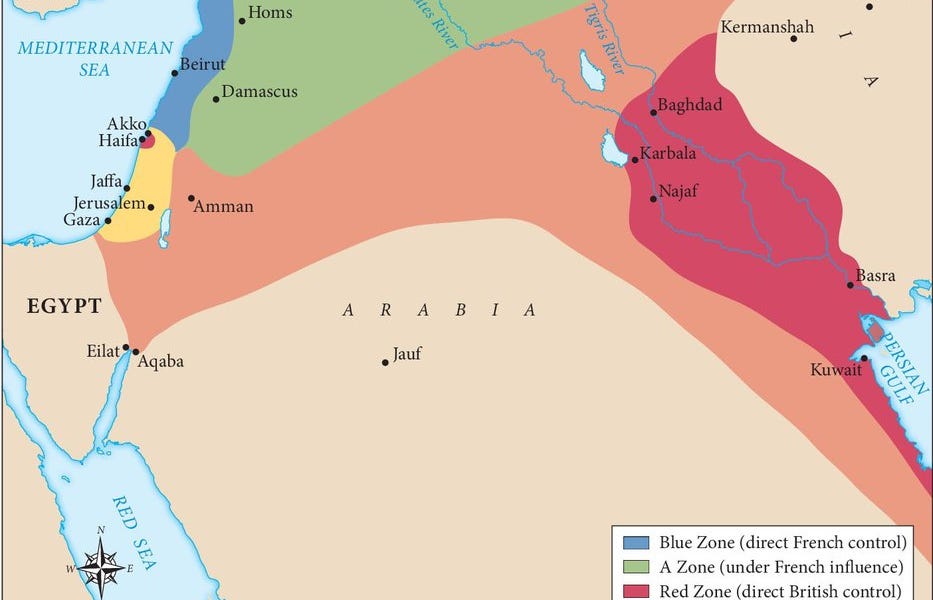

Moves that occurred 10 years ago are instructive of why we are where we are today and where we may be headed.

The announcement of the swap lines is likely a pre-announcement of an Economic Hitman-style attack on Saudi Arabia by the US. It’s not really that difficult to foresee.

For historical context, Russia was hit hard in 2014/15 by the collapse in oil prices. In retaliation for “stealing Crimea” an attack on oil prices was organized by President Obama and the gaggle of

usual suspects to trash the oil price.

In June of 2014 oil closed at $112.36. And the price began dropping the first trading day of July 2014 and didn’t stop until the end of 2015.

Saudi Arabia helped that process by expanding production, thinking they would take Russia’s market share as the Russian ruble collapsed and Russia’s foreign exchange reserves were drained.

The key to the anticipated win was that Russian companies, mostly the big State Owned Enterprises like Gazprom and Rosneft, had a lot of dollar-denominated debt which was about to mature and needed rolling over. So, the US sanctioned Russia such that companies like Gazprom couldn’t roll the debt over, because they couldn’t sell the bonds to US or European investors anymore. The current bondholders had to be paid off… to the tune of north of $50 billion in Q4 of 2014, and another $50 billions in Q1 2015.

This “rollover risk” would plague the Russian government’s finances for the next 18 months as the price of oil dropped relentlessly.

The Russian ruble dropped from the high 20’s/low 30’s versus the dollar rose to a high above 80 in late November, but it only happened after Putin personally ordered Bank of Russia President Elvira Nabiullina to let the ruble float. Before that there had been a soft peg to the US dollar in place, which was easy to maintain while oil was trading above $100 per barrel.

China stepped in at the height of the ruble’s collapse to give Russia a swap line between yuan and rubles. China paid off Gazprom’s debt. Russia paid them back in yuan, which they were going to get freely because of these swap lines then and Power of Siberia in the future.

The US didn’t dare sanction China for this because of both the blowback onto our economy and would have been tantamount to declaring war. It’s also why China didn’t get even threatened with sanctions after Russia “invaded” Ukraine last year.

That sweetheart deal for the gas now flowing to them through the Power of Siberia pipeline now makes a lot more sense. Personally I had misremembered it being signed in 2015, as a response to the crisis, but it was before the crisis even broke out.

That implies a few things: 1) the combination of of events of early 2014 prompted the formulation of a coordinated attack on oil prices aimed at Russia for later that year and 2) that Putin anticipated it and opened up negotiations with Xi Jinping to get Power of Siberia built quickly.

Nearly everything that’s happened since then is downstream of the events tracing back to early 2014

Russia survived that period of ‘rollover risk’ and in doing so created the blueprint for other countries to do the same.

Now, a tweet from Eric Yeung set all of what you are about to read spinning in my head immediately.

and my immediate response:

To which Eric replied:

So, to summarize before I go any further:

- China is using their US Treasuries and US dollar surpluses to loan them to Emerging Market trade partners of significance to CHINA!

- They are asking for yuan in repayment.

- This stabilizes the yuan/usd exchange rates while China can and is rapidly expanding the money supply to deal with their sagging property markets as a result of the Fed’s aggressively tight monetary policy.

- In order for China to expand the yuan into the new dollar vacuum without also losing their gold (Luke Gromen’s point during the conversation), they have to create a demand cycle for their debt, keeping borrowing costs low.

- Since they have cross-currency swap lines with their SE Asian partners and offshore yuan settlement around the region, i.e. in places like Singapore, this is how they manage the expansion without creating a runaway inflation problem.

- Yuan replace dollars without a massive shift in exchange rates and/or bond yields.

The 2014/15 ruble/rollover crisis was the test run for this. So, now. let’s go back to the beginning of the article.

You have to see this stuff in hindsight now, but in this case I think the past is prologue for the future.

Et Tu, Riyal?

So, now, start thinking about what the US and

Davos will do to the Saudis in a similar scenario. The Saudis have been defiant of the US’s demands to go along with US foreign policy excursions like Ukraine and Gaza while simultaneously working in tandem with Russia to keep OPEC+ together in the face of the West’s full court press to what….? Bomb the price of oil.

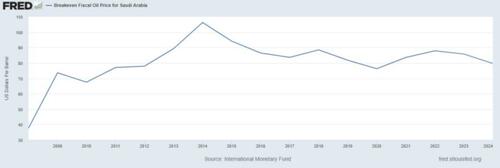

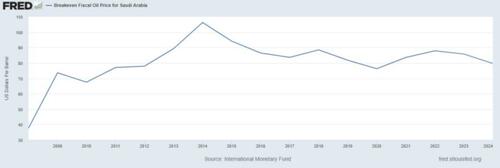

What most folks do not understand is that the Saudis have a similar problem today (and have had for over a decade), that while their costs of pulling oil out of the ground are extremely low, the amount of money Saudi-Aramco has to pay to the government to cover the government budget balloons that price.

So, while their COGS are low, their EBITDA is also low, depending on the price.

This is why (see graph annotations above) when the Saudis (henceforth KSA) went along with President Trump to trash the price of oil by pumping more and lowering their price in 2018, the gambit ultimately failed.

Their budget deficit exploded and Russia, with a free floating ruble and a flexible oil tariff regime outlasted the attack on oil.

As a comparison, Russia’s COGS are a little higher than KSA but their EBITDA is far lower. In fact, below a certain price per barrel (~$40, but it changes), Russian oil majors pay no taxes. It is a system a lot like US income taxes, progressively higher rates at higher profit margins.

But the Russians have a floating ruble to fall back on. No matter what the income level, they are paid in rubles. If oil is weak, the ruble should be weak and internally the costs to Gazprom or Lukoil for labor, SG&A, etc. is the same as if oil is high.

The US keeps attacking the ruble thinking it will bankrupt Russia but it won’t. Certainly now that they hold zero dollar-denominated debt and zero US treasuries as foreign exchange reserves. Attacking the ruble now is just petulance.

The KSA, on the other hand, as a riyal pegged tightly to the US dollar. Their COGS, EBITDA, everything may as well be in dollars, including labor costs, government subsidy costs, etc.

The solution, of course, is to break the peg of the riyal to the dollar.

Et voila, instant budget balancing at lower oil prices, just add foreign buyers offering not dollars.

Every year Thanksgiving week here in the US is marked by some kind of volatility in oil prices because OPEC+ holds their winter meeting this week every year. Thanksgiving week is a great time to screw with markets because the US is really distracted by holiday travel and logistics.

So, the other day infighting within OPEC+ by African nations including the

dutiful Davos-controlled nation of Nigeria postponed the meeting and was met with a washout in oil prices.

The Saudis need/want a put under the oil price of $80 per barrel. They need that to maintain their budget (see above).

China offers the Saudis a swap line to ensure breaking the peg goes smoothly. In other words, China will loan the Kingdom dollars to be repaid in yuan, just like they did for Russia and are currently doing today for their Southeast Asian trading partners trying to defend their currencies against the Dollar’s milkshake suction.

If we look back to history with Russia and Power of Siberia guaranteeing a big flow of yuan and rubles between Russia and China, might we see something

that would grease the skids of riyal/yuan flow?

As the kids on the Twitterz like to say, “kek.”

This OPEC+ meeting meant that a whole lotta schmoozing by

Davos through the Biden administration to break the cartel and let the price of oil drop is happening. It’ll be the same tired ploy as what they pulled with a willing KSA in 2014 and Trump worked them over for in 2018:

“We’re taking oil lower. Everyone else will suffer unless you pump like mad to us and we’ll reward you with increased market share in the US. After we let the price rise, you’ll be the new king.”

In the end all 2018’s attack did was finally get Crown Prince Mohammed bin Salman (MbS) to realize that the US is an unreliable and vindictive partner. He hitched the KSA’s and OPEC’s future on Putin and the Russians. He’s been rewarded for that choice to date.

The Saudis are preparing for an attack on the oil price to punish them for their lack of vision by the Neocons who never learn anything from their past failures.

Guess what? If Nigeria, Angola and Congo are hearing the sweet nothings of the West today I’d say they about to get rolled by Russia and China, but this time they will be joined by MbS and the Saudis, who are getting ready for the inevitable.

al-Asad military base in western Iraq, via AP

al-Asad military base in western Iraq, via AP