WHEN Vladimir Putin was bribing Viktor Yanukovych, then the president of Ukraine, to turn down a trade deal with the European Union last year, one of the sweeteners was cheap gas. The copious Russian gas Ukraine burns through every year—it is a profligate user of energy—would be priced at just $268.5 per thousand cubic metres (tcm), which for 2013’s total of 28 billion cubic metres (bcm) works out at $7.5 billion. Since February’s revolution ousted Mr Yanukovych, gas has become a stick, not a carrot. On April 1st Alexei Miller, the chief executive of Russia’s gas giant, Gazprom, said that the price of Ukraine’s gas was going up by 44%, to $385.5 per tcm.

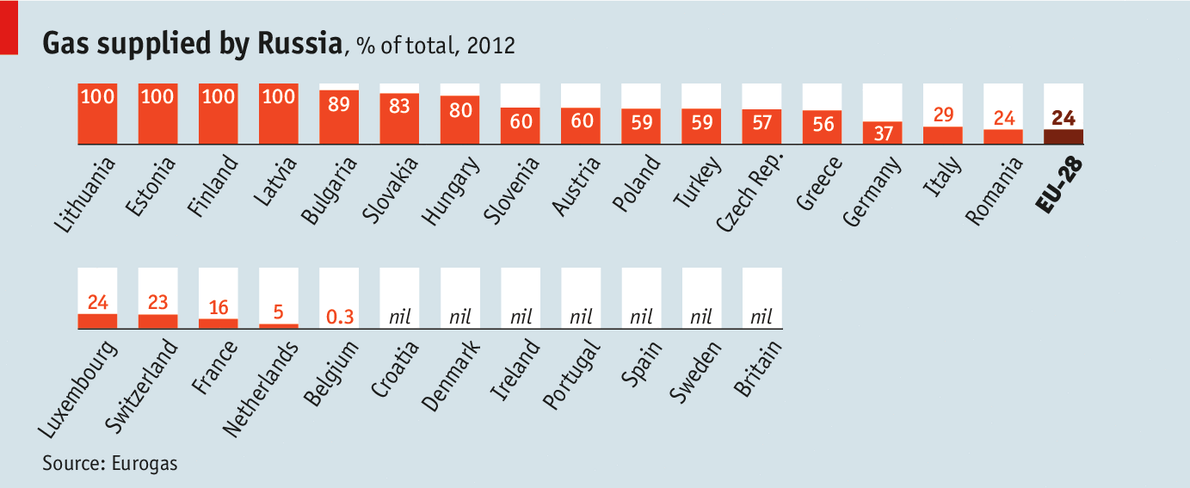

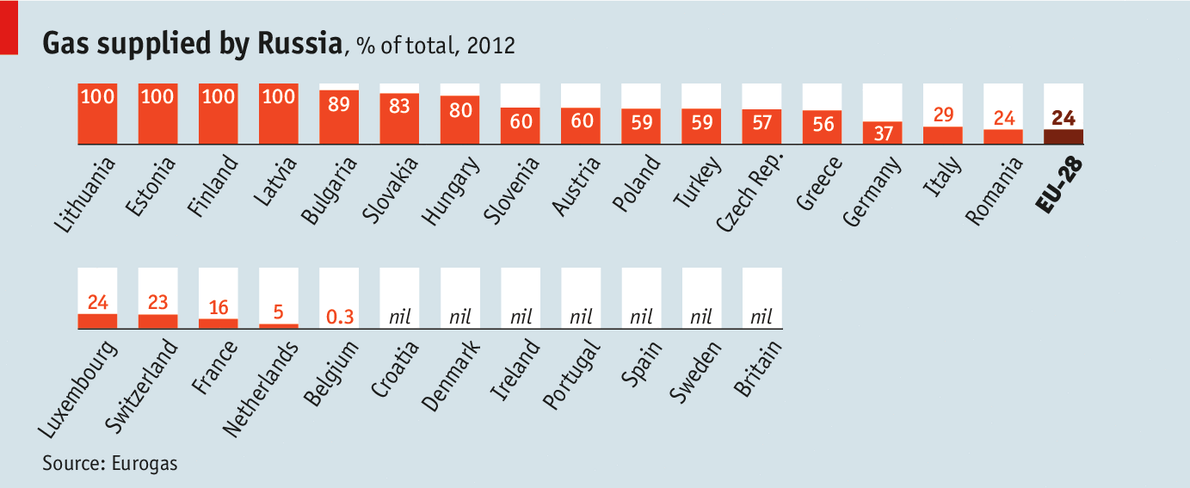

This is ominous news for Europe. Ukraine already owes Gazprom $1.7 billion, according to Mr Miller. If Ukraine continues not to pay its bills—and without outside help, it cannot—Gazprom can cut it off. Such a dispute need not, in principle, have any effect on the gas that flows through Ukraine to other countries farther west (see map). But if Gazprom reduces the flow of gas to reflect the fact that Ukraine no longer has a right to its 28bcm, and Ukraine takes some of that gas anyway, or if Gazprom shuts down the pipelines going through Ukraine completely, Europe’s supplies get hit. Europe gets 24% of its gas from Russia, and half of that—80bcm a year—passes through Ukraine. An argument between Russia and Ukraine led to the pipelines shutting down for two weeks in January 2009, to much consternation downstream.

In the short term (weeks, or a few months) such a disruption would be less damaging now than it was then. But in the medium term (many months, or a few years) Europe remains highly vulnerable to Russian control over gas supplies. This vulnerability is one of the reasons why Mr Putin thinks Europe will not act decisively against him over the annexation of Crimea, or any further territorial depredations he may have in mind. But it is a vulnerability that can, over time, be decreased; and one which Russia would lose a lot by exploiting.

Thanks for sharing

At the moment, a lapse in supplies would see the seasons in Europe’s favour. European countries do not depend on Russian gas in the summer months (though they do refill their storage facilities with it then). And the mild winter just past means that those stores are unusually full. Richard Mallinson of Energy Aspects, a consultancy, says EU countries have 36bcm of gas in store, about 15bcm more than this time last year. They could store twice that; the EU’s total storage capacity is 75bcm.

It is a useful cushion, but a lumpy one. Some European countries have lots of storage: Latvia has at least a years’ worth. Others (Moldova, Macedonia) have none. Thus ways must be found to get gas from the places where it is stored to the people who need it. Europe’s pipeline grid is not particularly well suited for this. National gas companies have long disliked cross-border interconnectors; a free flow of gas means more choice for consumers and thus lower prices. But pressure from the EU—notably in the form of the “third energy package” of liberalisations—and a growing concern, since 2009, about the risks of relying on Russian gas mean that more interconnectors have now been built, along with pumps that can reverse the flow in transit pipelines.

Poland has been connected with the Czech Republic via the small Stork pipeline since 2011; work on a larger link, with a capacity of up to 10bcm, will start before 2017. Slovakia has just opened a pipeline to Hungary. Germany can now send gas to Italy, as well as to Poland and the Czech Republic. If the political will to provide mutual support is there—quite a big “if”, since it was not very apparent in 2009—the means to do so are better than they were.

Estonia, Latvia and Lithuania, though, are not connected to any source of gas save Russia. Work could start on an interconnector from Poland to Lithuania in 2018; until then Latvia’s abundant storage provides some insurance against strong-arming. Bulgaria also has a particular problem. It gets almost all its gas from a Russian pipeline that crosses Ukraine, and it has limited storage (less than two months’ consumption). It is hurrying to build interconnectors to Serbia and to a planned liquefied natural gas (LNG) terminal in Greece.

Even good interconnection is only a solution for as long as there are gas supplies to feed the interconnectors. If the gas ceased flowing through Ukraine, where might more be found after stores were depleted?

One answer is, surprisingly, Russia. If Russia were to shut down the pipelines across Ukraine with the principal aim of hurting Ukraine itself (though accepting mind-focusing discomfort downstream as an added bonus) it would probably continue exporting gas by other channels. One of them, the newish Nord Stream pipeline on the Baltic seabed, was to some extent built with this in mind; it was designed to get gas straight from Russia to Germany, and thus give Russia the option of cutting off its near neighbours while still serving its most important market.

Now interconnectors allow gas to flow south and east out of Germany, though, Nord Stream could be something of a boon—all the more so because, at the moment, only around 30bcm of its 55bcm a year capacity is used. Assuming regulatory and commercial issues were resolved, and that Russia was not actively seeking to make things worse, the other 25bcm could make up a good chunk of the shortfall if supplies through Ukraine were stopped.

Help is round the corner

Finding much more by way of replacement gas, though, would be hard. Perhaps 10bcm could come from Norway. Shares in Statoil, Norway’s state energy company, have jumped by 7% since the revolution in Ukraine, notes John Olaisen, an analyst at ABG Sundal Collier, a Norwegian bank. But the scope for further production inside the EU is limited. In the Netherlands public opinion wants the country to pump less gas, not more, because of worries about carbon emissions and a string of minor earthquakes associated with the depletion of the giant Groningen field. Britain’s gasfields are also depleting. North Africa has proved an unreliable supplier, beset by terrorist threats and other unrest. Italy’s imports from Libya, once a reliable supplier, were down by 11.9% in 2013; supplies from Algeria (where local demand is booming) were down by 40%.

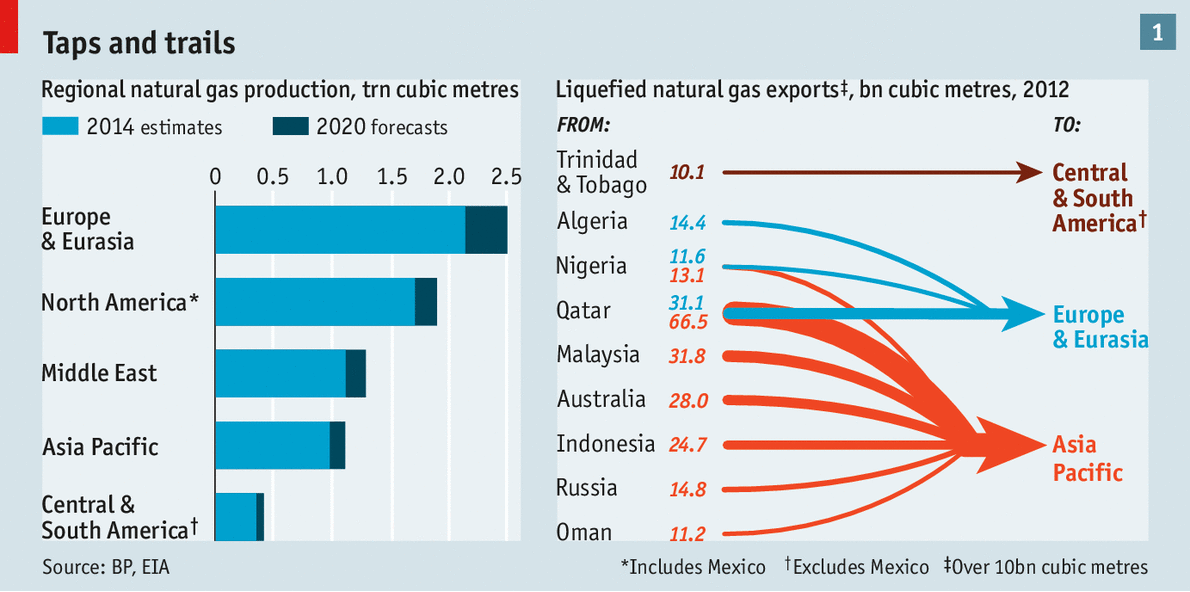

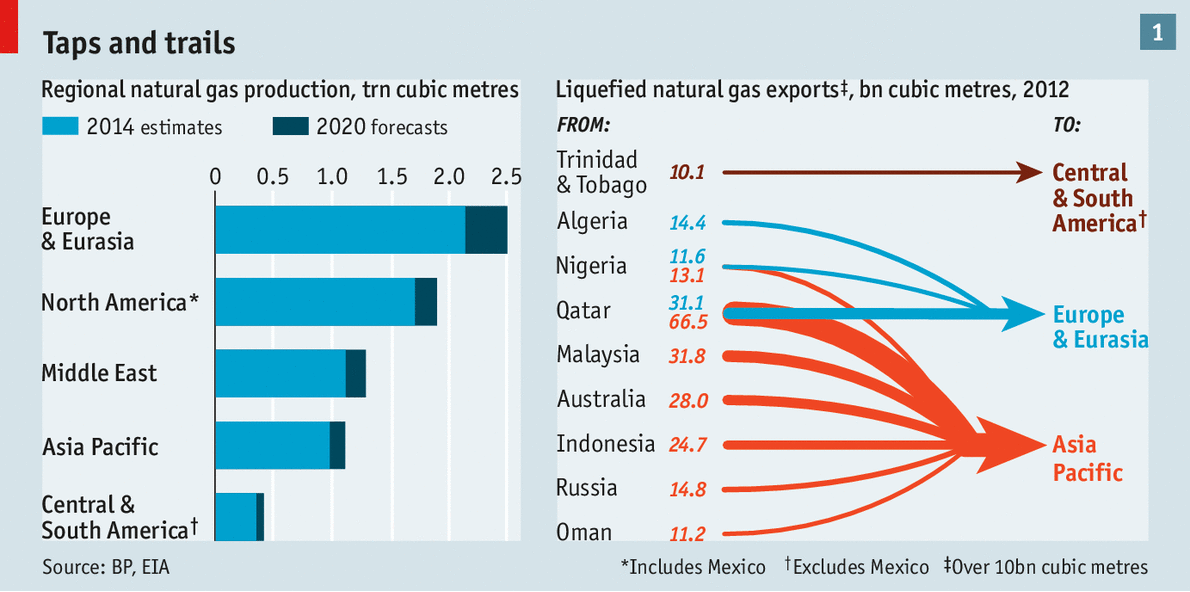

What about gas from farther afield? Europe has the capacity to import a lot more LNG; its 2013 LNG imports, 45.7bcm, were much lower than the 2011 peak of 86.5bcm. The problem here is inelastic supply. The countries which export LNG cannot simply churn out more of the stuff; the plants which liquefy the gas cost billions of dollars, so they tend already to be running at full blast. And most of what they make they are already selling, at high prices, in Asia (see chart 1). Japan needs LNG to keep the lights on, having shut down its nuclear power plants after the Fukushima disaster. China is trying to burn less coal because of public anger at air pollution. Europe might be able to find another 10bcm of LNG, analysts reckon, but it would pay about twice what Russian pipeline gas currently costs.

There is also the option of generating electricity from coal instead of gas. But a knock-on effect of America’s shale-gas revolution is that it now exports cheap coal to the EU (this is in part why LNG imports have declined). Europe is already running most of its coal-fired stations at high capacity. There might be some slack, and there are also some mothballed stations that burn fuel oil, but there is no large pool of underused generating capacity.

Add all this together and you get around 50bcm. That means Europe would still face a 30bcm shortfall if supplies through Ukraine were cut off completely—just under half of Germany’s annual gas consumption. And even getting that far is possible only at the cost of perhaps $50 billion more spent on gas; bringing in a significant amount of LNG at Asian prices means other vendors not locked into long-term contracts will raise prices, too. Particularly cold winter weather would make things a lot worse. Given the continent’s 117 gigawatts (GW) of wind-turbine capacity, which has been growing at 10% a year, windy weather would improve matters.

Rather than face the economic pain that a 30bcm gas shortfall would impose, Europe’s leaders will focus on helping Ukraine pay its bill. This is one reason why prices for traded gas have barely budged since the crisis started. Sorting out the country’s notoriously murky energy sector will be high on the reform agenda (Ukraine still does not have meters at the points where the pipelines enter from Russia, making all discussions about quantity and price questionable). Cuts in the energy subsidies which lead Ukrainians to burn gas so wastefully are sure to be required in return for money from the IMF. Ukraine currently produces 20bcm of gas; if it were as efficient in its use as some countries are, it could be more or less self sufficient.

Europe will also seek to lessen its reliance on Russia in the longer term—a challenge made all the harder by the fact that current trends have gas demand going up in the decade to come. According to AT Kearney, a consultancy, imports are set to climb from 327bcm today to 413bcm in 2020.

Bigger, stronger

In March the EU’s heads of government told the commission to produce a plan in June for reducing energy dependence. That is likely to give a push to storage capacity and both more and larger interconnectors. It could strengthen requirements for countries to maintain a strategic gas reserve, and it ought to stress energy efficiency, too.

It will also look at new pipeline plans. An immediate casualty is likely to be Russia’s South Stream pipeline, which, like Nord Stream, was designed to reduce Gazprom’s export dependence on Ukraine. Due for completion in 2018, with a planned capacity of 63bcm, it has already fallen foul of EU competition rules, and EU disapproval could effectively scupper it. The corollary to spurning Russian gas piped through South Stream is favouring non-Russian schemes like the Trans-Adriatic Pipeline, due for completion by 2018, which will bring Europe 10-20bcm a year from the Caucasus via Turkey. An easing of sanctions on Iran could bring more gas from there by the same route.

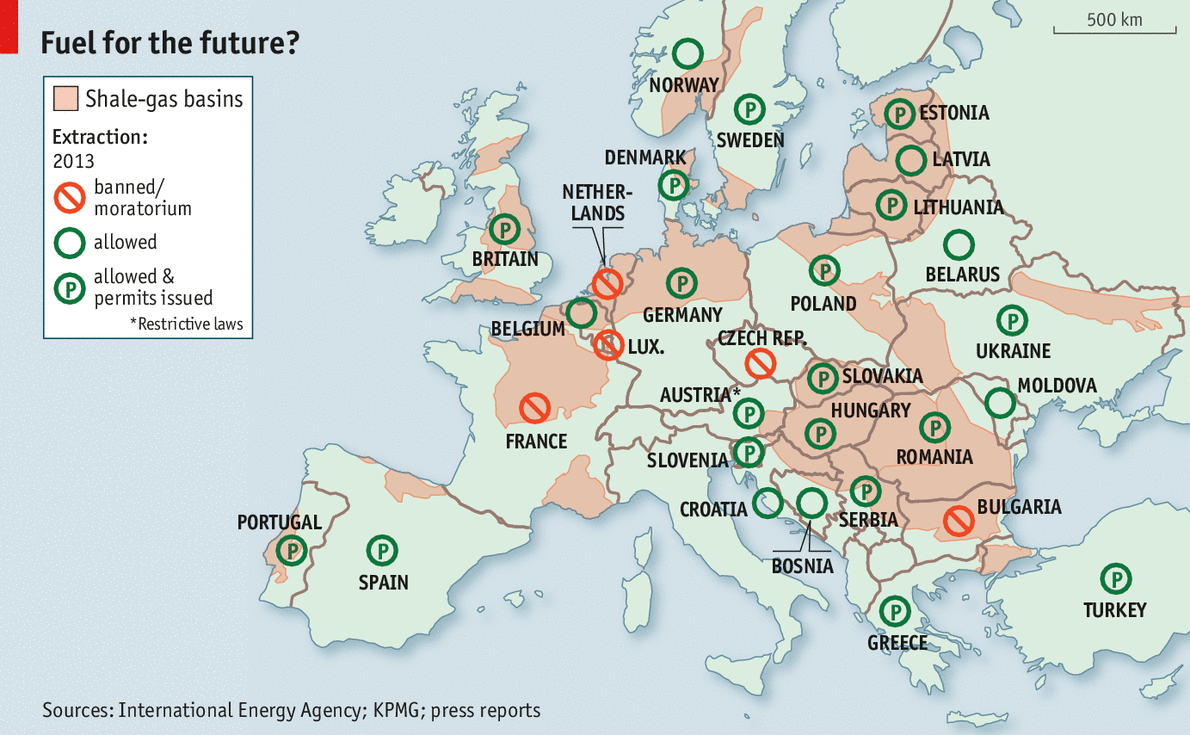

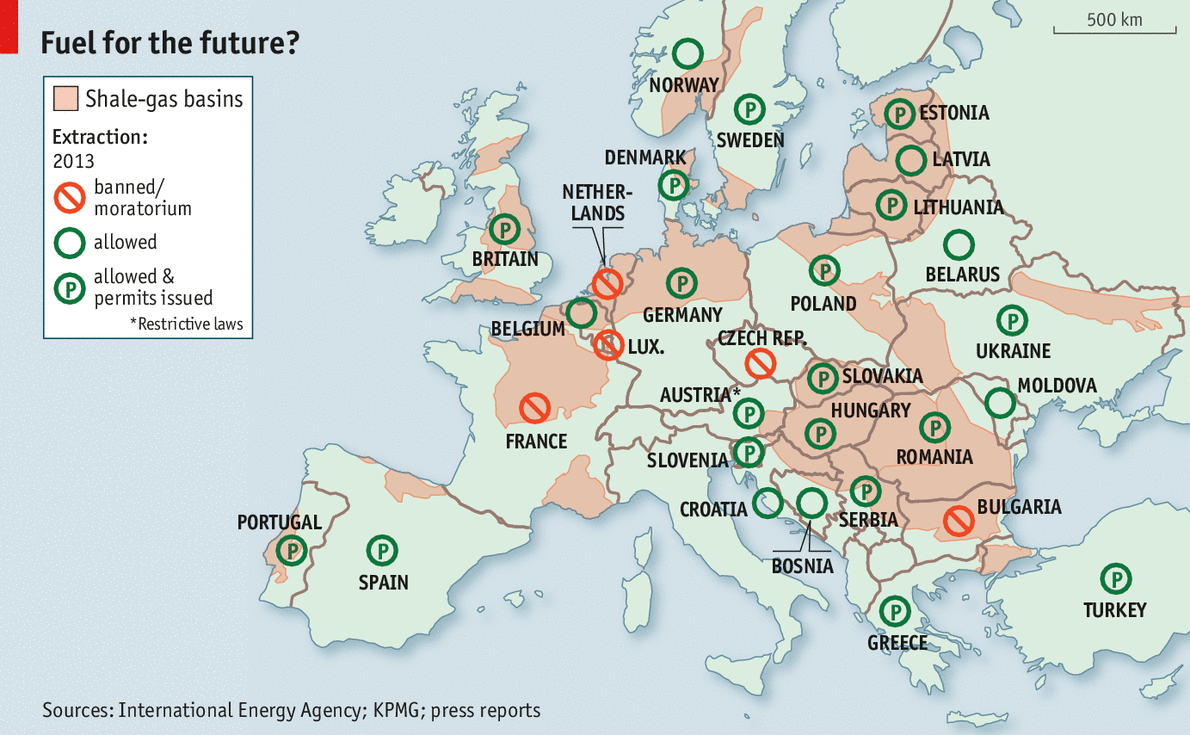

Europe could also develop its shale-gas reserves (see map), though these are not the panacea enthusiasts would like to believe. The EU’s Joint Research Centre puts Europe’s technically recoverable unconventional-gas resource at 11,700bcm, about a quarter of America’s. But law, public opinion and a lack of drilling and exploration kit make European shale gas harder to get out. IHS, an energy consultancy, expects that by 2020 European shale production will only be 4bcm a year, compared with over 70bcm in America today. Conventional-gas production in Europe and its neighbouring seas could drop by ten times that over the same time.

Political excitement about the idea of America’s shale gas helping Europe out tends to overlook the practical difficulties. For a start, there are not yet any export facilities. Sabine Pass on the Texas-Louisiana border, with a capacity of up to 2bcm, will start pumping LNG only in 2015. Two dozen export applications are pending, though, and IHS reckons that a burst of projects coming online in 2018–20 will bring America’s total LNG export capacity to 66bcm by early in the next decade. That is appreciable, but hardly overwhelming in a world LNG market that might be 540bcm a year by that time, according to the International Energy Agency. And a significant part of that gas would be headed to high-price Asia, not just from plants on America’s Pacific coast but also from the Gulf, since from 2015 the new locks on the Panama Canal will enable it to take large LNG carriers.

All this depends on investors coming up with the money. But private-sector investors may be chary of putting money into costly terminals that risk not being used if Europe slips back into accepting more cheap Russian gas. And although the crisis in Ukraine has stoked America’s willingness to help allies, there is a domestic lobby that thinks restricting exports will keep prices at home low.

Technological change may help matters. The cost of import terminals that turn LNG into usable gas has fallen sharply, with customers now able to rent floating facilities when they need them, rather than building costly ones on land. Lithuania’s new $325m floating LNG terminal, the South-Korean-built, pointedly named

Independence, will start work by the end of this year. In the longer term, liquefaction plants which use electric motors rather than huge turbines look set to reduce the size and capital costs of export terminals. That could bring much more LNG onto the market from offshore fields and remote places.

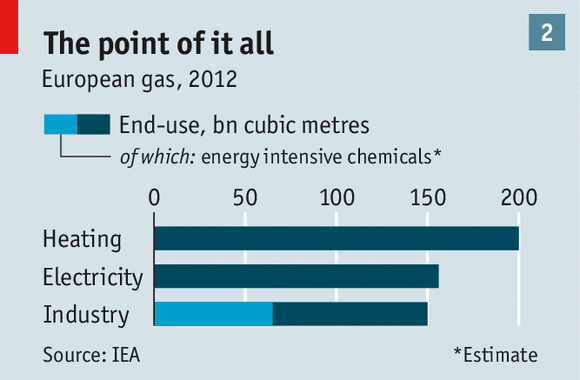

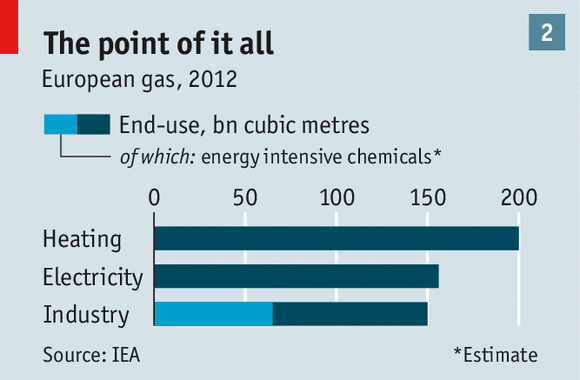

Since Europe uses 31% of its gas to make electricity (see chart 2), it is also possible to reduce reliance on Russia by changing generating technology. To some extent Europe’s push for renewables is already doing this. But at the moment renewables need fossil-fuel-fired capacity for backup, and gas is the fuel of choice. Better electricity interconnectors could reduce that need for gas by making it easier to export electricity from renewables-rich markets like Germany on sunny or windy days and to import it on dark or still ones. As with gas interconnectors, forging such links requires a pan-European push. And to make it work on a large scale will require new pricing strategies to recompense the owners of fossil-fuel plants pushed off the grid when renewable energy from other countries flows in.

Interconnectors can also help substitute one renewable for another. Hydro-power, like gas-fired power stations, can be turned on easily when the wind falters, but it is not evenly spread: Sweden and, particularly, Norway have a lot of it, Germany and Benelux not so much. There are currently plans for up to five new interconnectors from Norway to the EU to be built by 2020, with a capacity of up to 5GW (providing 5GW from gas plants would take around 10bcm a year). Norway could generate much more hydropower, given a market. And with better interconnectors, a lot more solar power could come up from the south—perhaps including north Africa.

Though making a real dent in Europe’s reliance on Russian gas will take political will, money and the best part of a decade, merely moving in that direction will shift the balance of power, because it will signal a fundamental truth: in the end, the Kremlin needs its European customers at least as much as they need Russian imports.

The avengers

Oil-and-gas exports make up 70% of Russia’s $515 billion annual exports, and 52% of the federal budget, according to America’s Energy Information Administration. Europe’s role as Russia’s largest gas market already gives it a certain strength, as can be seen in the increasingly hard-nosed way EU competition officials are taking on some of Gazprom’s practices.

Oil (unlike gas) is easy to store, ship and trade, which means a single customer has less scope for action. But to sell its oil easily, Russia needs access to the world financial system. Its companies need to borrow on the bond market, and want their shares traded on international exchanges. They also need to process payments in dollars (the currency in which almost all international energy transactions are priced).

This gives Europe and America considerable leverage, if they choose to exert it. Rosneft, Russia’s biggest oil company, would be badly damaged if it were to be delisted on the London and New York stock exchanges. Financial sanctions could also make it hard for Russia to sell its oil to third parties. Sanctions have hurt Iran not by stopping it getting oil to customers, but by stopping it from receiving payment (though Russia would be harder to isolate).

In theory, Russia’s gas exports to Europe are a weapon that points the other way. If Russia were to push farther into Ukraine, or to try its chances in Moldova, Georgia or the Baltic states, and Europe to take strong action in response, it could shut down exports completely, thus doing huge damage to the EU. But barring immediate, permanent and total victory, that would also doom Russia as a gas exporter. China already has worries about Russia’s dependability as a supplier. Even with $475 billion in foreign-exchange reserves, the Kremlin cannot continue to run Russia’s ramshackle and uncompetitive economy without its most important export revenues.

The shock of the Crimean annexation should speed up sluggish European decision-making on storage, interconnection, diversification, liberalisation, shale gas and efficiency. And though the decision-makers may detest Mr Putin, in private they will admit that he may thus have done them a favour. They already knew what to do. They just didn’t want to do it.

За последниов линк.

За последниов линк.